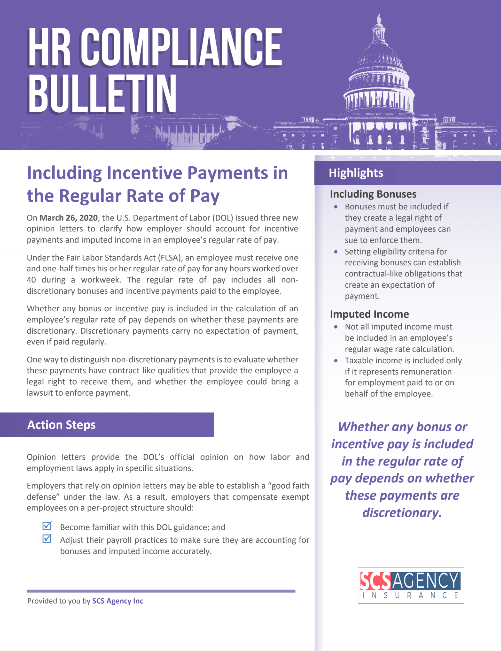

On March 26, 2020, the U.S. Department of Labor (DOL) issued three new opinion letters to clarify how employers should account for incentive payments and imputed income in an employee’s regular rate of pay.

Under the Fair Labor Standards Act (FLSA), an employee must receive one and one-half times his or her regular rate of pay for any hours worked over 40 during a workweek. The regular rate of pay includes all non-discretionary bonuses and incentive payments paid to the employee.

Download the resource to learn more.