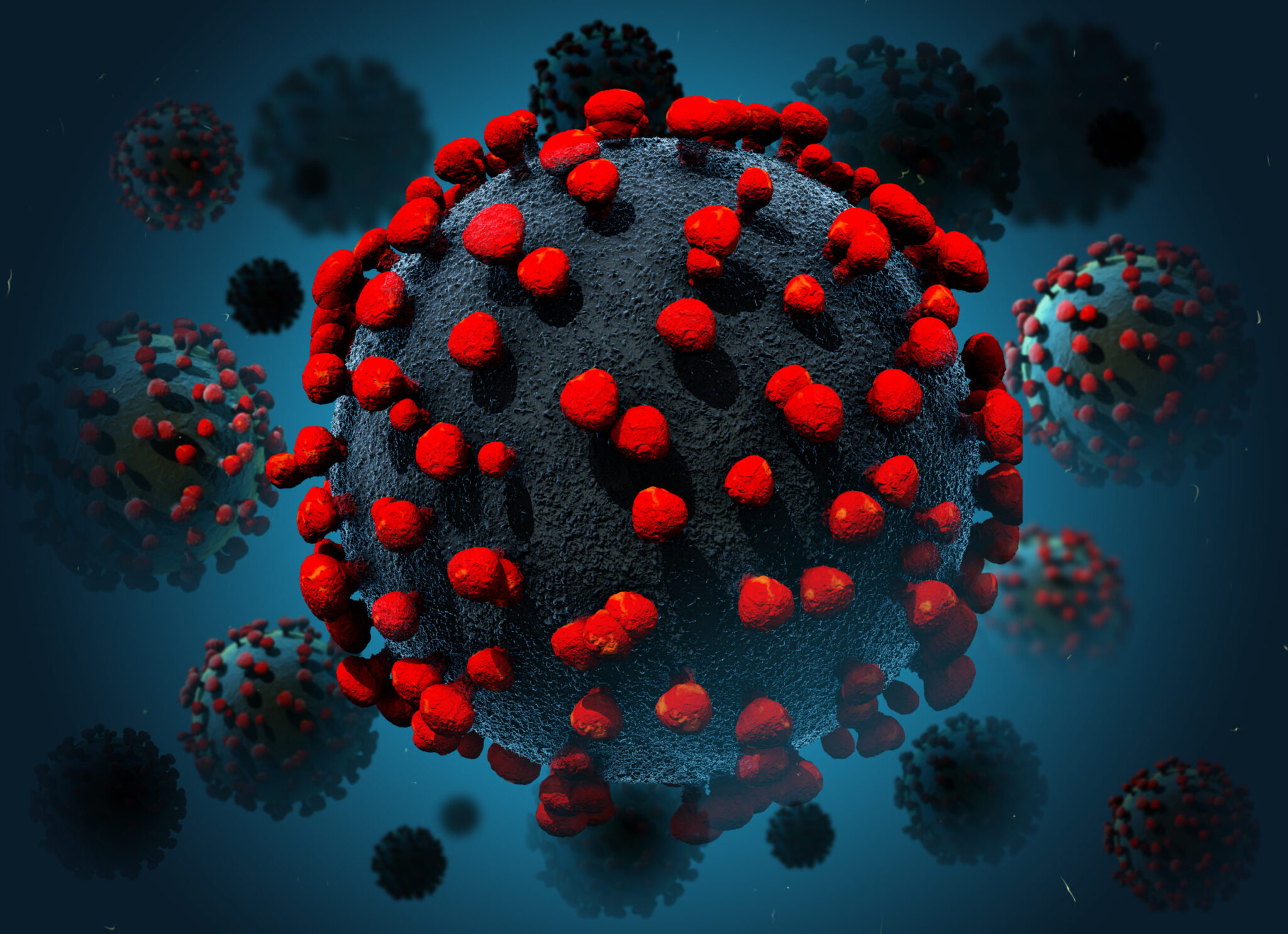

To do this, we will be making a few changes that will help us check in with our clients more consistently, while keeping you and our team members safe. Here are some of the things we are doing:

- We have ensured that there will be no disruption in our service to you. All of our employees are fully equipped to work remotely. Our IT infrastructure is backed up and secured.

- We'll be prohibiting any visitors from entering our offices until further notice. This measure protects any employees that will be onsite.

- All of our phone lines will work as you are used to. We ask you to please leave a message to ensure all calls are returned.

Thank you for your understanding as we take these precautionary steps. If you have any concerns, please reach out to your SCS Account Executive. Additionally, keep checking this page as we will continue to update it.

Helping Our Long Island Families with Island Harvest

We are proud to announce that we have partnered with Island Harvest to collect donations in support of the Long Island community, with our mission of “families helping families” in mind. With just a $25 donation, meals for 3 to 4 days can be supplied to children, seniors, veterans, and families across Long Island! We invite you to join us in donating whatever you can, our community needs our help now more than ever.

Updates & Resources

Cyber Liability – Top Ten Cybersecurity Misconfigurations from CISA/NSA

CISA and NSA unveiled prevalent cybersecurity misconfigurations. Explore these common issues and learn mitigation strategies to safeguard your organization.

Recruiting and Hiring Winter and Holiday Seasonal Employees

Bulk hiring workers can present unique challenges for employers. Here’s how to successfully recruit and hire winter and seasonal employees.

How Artificial Intelligence Can Help Bolster Workplace Safety Infographic

This infographic provides more information on how organizations can leverage AI technology to bolster their workplace safety efforts.

Small Business Insights – The Pros and Cons of a Sole Proprietorship

Understand the signs and symptoms of heat illnesses and tips to prevent them in this quarter’s Agriculture Risk Advisor Newsletter.

Nation’s Trucking Industry Under Siege by Worsening Litigation Trends

The trucking industry is the “lifeblood” of the U.S. economy, but is “under siege by litigation,” according to a new report from the U.S. Chamber of Commerce Institute for Legal Reform (ILR).

National Cybersecurity Awareness Month 2023 – Social Media Flipbook

October is National Cybersecurity Awareness Month. Here are four simple steps employees can follow to help keep your business cybersecure.

Know Your Insurance: Collision Coverage

Collision coverage is a type of auto insurance that can help pay for damage to your vehicle from collisions, regardless of who was at fault in such incidents. Download this Know Your Insurance article to learn more about collision coverage.

Cyber Liability – The Risks and Legal Implications of Pixels and Tracking Technology

Explore the risks and legal implications of pixels and tracking technology, and uncover tactics to reduce related exposures.

Creating a Mentally Healthy Workplace – Infographic

Work environments have a significant impact on employees’ mental health. This infographic provides guidance on how to create mentally healthy workplaces.

Small Business Insights – The Importance of Business Interruption Insurance

Business interruption insurance can play a key role in ensuring operations resume following a catastrophe. Download this Small Business Insights flyer to learn more about the importance of business interruption insurance.

Need further assistance? Reach out to your SCS Account Executive or drop us a line.

Proudly serving Lake Success, NY, New York, NY, Brooklyn, NY, Tri-State Area, NY, Nassau County, NY, Fairfield County, CT, and surrounding areas. Licensed in over 20 states

At SCS, we have the capacity to service large national companies, in addition to using the same consultative platform for family owned local businesses.